Expert Opinion and Price Expectations in the Real Estate Sector

Recently, there has been uncertainty about housing prices in the real estate sector. For 2024, many experts predict a decline in housing prices. However, this decline is not expected to materialize due to increases in construction costs and allegations that big players are manipulating the market. It is observed that square meter prices continue to rise, especially in the Levent region.

The economic losses brought by the pandemic, the Russian-Ukrainian war and the Israeli-Palestinian conflict have deeply affected the real estate sector. Foreign currency-indexed cost increases in the construction sector and the shortage of qualified personnel caused many companies to stop their projects.

On February 6, a major earthquake severely damaged 11 cities. This situation reduced the housing stock and raised house prices. While there is an annual need for one million houses in our country, we cannot meet this need. Unless there is sufficient supply, it is not possible for housing prices to fall.

Real estate is the safest and most profitable investment instrument in the long term. Buying a land, apartment or commercial property can be challenging at the beginning, but the returns in the long run cannot be ignored. Celebrities have also realized the power of real estate and use the same phrases.

Every crisis is an opportunity. Investors are the ones who turn a crisis into an opportunity. The money invested in interest will be insufficient against inflation and will be insufficient for real estate purchases in the future. Therefore, I recommend them to buy the house they want to buy before it is too late.

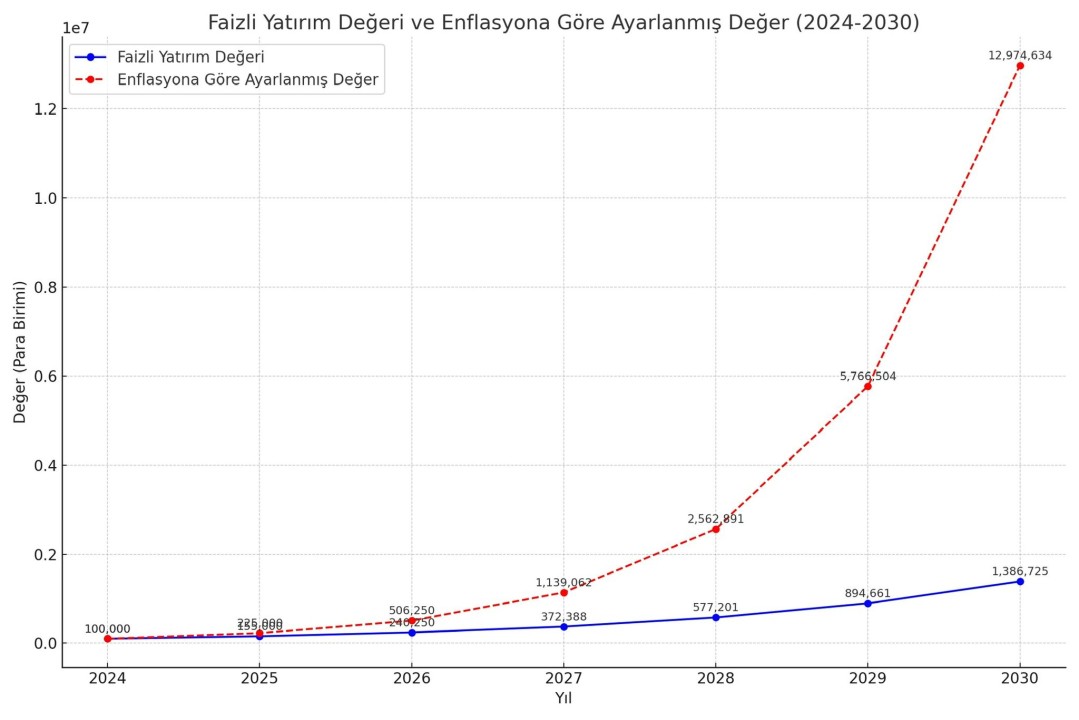

Interest and Inflation Graph

Blue Line (Interest Bearing Investment Value)

Red Dashed Line (Inflation Adjusted Value)

Important Note: Over a 7-year period, even though the nominal value of the investment grows with interest income, the real purchasing power of the investment decreases significantly due to inflation. This shows that even investing money in interest income is insufficient against inflation in the long run.

Love and respect.

Investment and Real Estate Expert,

Semih SARIALİOĞLU